As Hollywood’s Bests, These Stars Are Now Living The Life They Deserve In Their Envy-Inducing Mansions

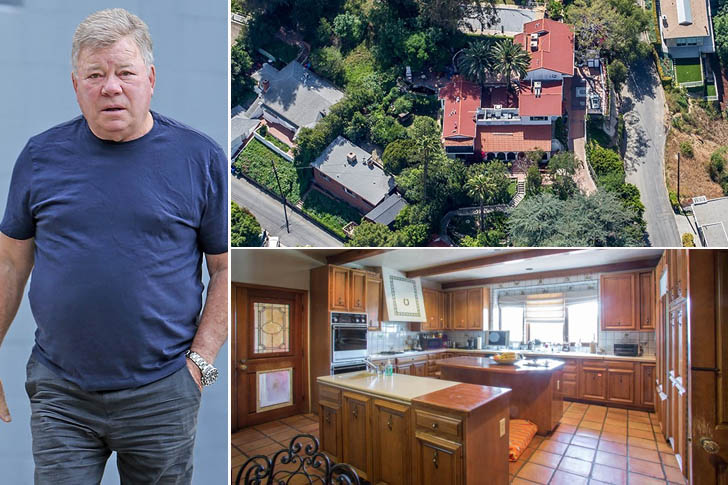

WILLIAM SHATNER – $3 MILLION, STUDIO CITY

William Shatner William Shatner was born in the community of Notre-Dame-de-Grace in Montreal, Quebec, Canada, and lived in a conservative Jewish family. He is a Canadian actor, writer, producer, director, screenwriter, and singer. He rose to prominence when he played the role of Captain Kirk in the Star Trek movie and T.V. series. With his experience, he also wrote several novels about his character and time doing the iconic film franchise. which has been adapted for television.

He started in the business in 1951, and from here, the rest is history. He went on to appear in different T.V. and movie projects, like T.J. Hooker, Rescue 911, The Practice, Boston Legal, and Better Late Than Never, among others. At 89, he already retired from playing Captain Kirk, but he would always be the starship captain in everyone’s mind. Now, he is mostly spending his time in his $3-million mansion in Studio City, California, which may have the right home insurance.